Leasing your fleet instead of purchasing outright can help your business reduce expenses, improve cash flow, and stay ahead of operational demands. Our Fleet Leasing and Savings solutions offer cost-effective lease structures tailored to your business needs, ensuring you get the best value for your fleet.

Choose from open-end, closed-end, or TRAC leases customized to your operational and financial needs.

Reduce long-term expenses with lower acquisition costs, depreciation risk mitigation, and optimized fleet efficiency.

Avoid unexpected expenses with lease agreements that cover routine maintenance, servicing, and repairs.

Monitor fuel consumption and fleet spending to maximize cost savings and efficiency.

Take advantage of tax-deductible lease payments and government incentives that enhance financial flexibility.

Protect your business from depreciation uncertainties by transferring residual risk to the lessor.

Upgrade to the latest, most fuel-efficient vehicles without the financial burden of purchasing.

From acquisition to renewal, we handle every aspect of your fleet leasing strategy for a seamless experience.

Easily expand or reduce your fleet size to meet changing business demands.

Upgrade your fleet without the financial burden of ownership.

Maximize financial benefits with lease-related tax deductions and incentives.

Leasing offers businesses financial flexibility while keeping operational costs predictable. Our lease options include open-end, closed-end, and TRAC leases tailored to different fleet requirements. By offering customized leasing structures, we help businesses acquire the right vehicles without the burden of large upfront costs or ownership risks.

A well-structured lease can significantly reduce long-term expenses. Our fleet leasing solutions provide businesses with fixed monthly payments, maintenance-inclusive plans, and cost-saving fuel management strategies. By optimizing financial efficiency, companies can allocate resources more effectively and focus on core operations.

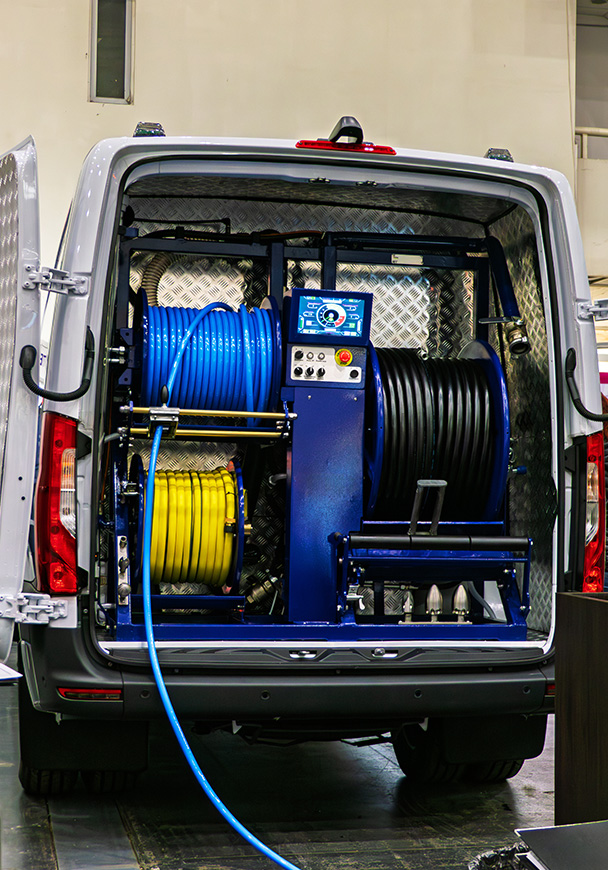

A vehicle fleet is the number of vehicles any business, institution, or agency operates to run their business. Any combination of cars, vans, trucks, and specialty vehicles. Basically, anything that is registered and rolls on streets and highways is considered part of a fleet.

If you have more than one vehicle, you have a fleet — but depending on the type of business, you can qualify for fleet status with some manufacturers with as few as three to five vehicles.

When used properly, acquiring vehicles through fleet ordering platforms will cost less money than if purchased from dealer stock through the retail platforms. There is also more long-term pricing consistency through fleet ordering platforms compared to the rollercoaster retail side of the automotive business.

Capital Lease Group is a commercial fleet leasing business offering many types of lease structuring options to best match the needs of a business. We do not lease to individuals. This is what differentiates fleet leasing from traditional vehicle leasing.

When you lease your persona car, that’s called a consumer lease and it locks you in using one type of lease structure only. With commercial fleet leasing, you have many more choices of lease structures available to you.

Capital Lease Group can provide you with leases that will reduce or eliminate all risks of lease-end obligations. We have leases that you can opt-out of with no penalty after one full year in service. We have leases that allow unlimited mileage and no excess mileage bill backs. We have leases where you can recover lease end value when the lease terminates. We provide leases that include all maintenance and repairs, vehicle insurance, registration, and excise tax processing. Consumer leases don’t do any of that.

Fleet management is the process that encompasses all of the above and more. It can either be done entirely by the business, or they can outsource some or all phases of it to a fleet management company. It’s been our experience that businesses manage none or some but not all phases of their vehicle fleet process properly. We like to think of it more as the difference between fleet management and “Successful Fleet Management.”

There are five phases or steps in the fleet management process, and when all are done properly, it’s successful. When they are not, you should consider outsourcing for help in the areas in which you are weakest.

On a very high level, the five phases are listed below, but chapters could be written detailing the make-up of each phase. When all are done properly, your fleet will operate like a well-oiled machine, getting the most out of it at the lowest overall expense.

The five phases are:

On a very high level, the five phases are listed below, but chapters could be written detailing the make-up of each phase. When all are done properly, your fleet will operate like a well-oiled machine, getting the most out of it at the lowest overall expense.

The five phases are:

Sure you can! We realize a lot of companies that are developing new territories may require more or fewer miles than originally anticipated. We are able to re-write the lease mileage based on the newer, more accurate information, and may even be able to adjust the terms to be more favorable as well.

Of course. It makes a lot of organizational sense to do this, especially for your accounts payable department and your Fleet Manager. In some cases, consolidating the billing can result in reducing the monthly costs as they are rewritten and restructured.

Yes! Having a good business plan showing positive cash flow and with strong ownership will get our attention and interest in providing vehicles and equipment to start-up companies.

Yes. We can design a maintenance plan to fit your fleet’s needs, enabling you to know what your fixed costs will be.

Yes. We are partners with a large national company to be able to provide this valuable service and give our customers peace of mind.

We have expertise in this area which allows us to take the burden off our clients’ shoulders. Once a claim has been set up with your insurance company, we can handle everything — from towing (if needed), to body repair and a replacement vehicle if your policy allows.

Let’s find the best leasing solution for your business